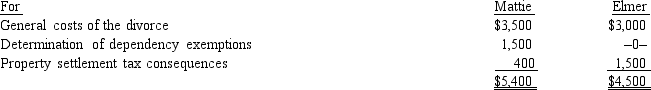

Mattie and Elmer are separated and are in the process of obtaining a divorce.They incur legal fees for their respective attorneys with the expenses being itemized as follows:

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

Although there is no requirement that he do so,Elmer pays Mattie's lawyer as a gesture of the positive feelings he still has for her.

a.Determine the deductions for Mattie and for Elmer.

b.Classify the deductions as for AGI and from AGI.

Definitions:

Economic Profits

The difference between total revenue and total costs, including both explicit and implicit costs, representing surplus remaining after all costs are covered.

Perfectly Competitive

A market scenario characterized by an infinite number of buyers and sellers, freedom of entry and exit, and a product that is homogenous across all suppliers.

Constant-Cost Industry

An industry where the costs of production do not change as the industry's output changes.

Long-Run Equilibrium

A state in economic theory where all factors of production are fully adjustable, allowing for optimal resource allocation and full competition.

Q9: Why was the domestic production activities deduction

Q9: Rachel owns rental properties.When Rachel rents to

Q12: The Federal per diem rates that can

Q19: Keogh (H.R.10)plans<br>A)Cover charge paid to entertain client

Q40: Abner contributes $2,000 to the campaign of

Q49: On July 15,2014,Mavis paid $275,000 for leasehold

Q57: When a business is operated as an

Q58: A moving expense deduction is allowed even

Q74: Kirby is in the 15% tax

Q75: Bobby operates a drug trafficking business.Because he