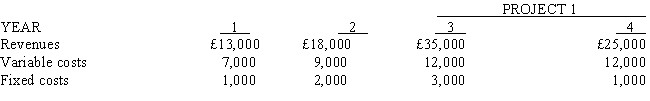

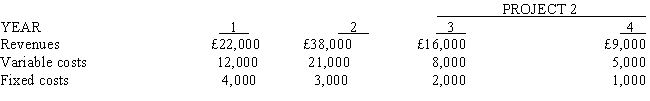

Maxim, Inc., is considering two mutually exclusive projects. Project 1 requires an investment of £40,000, while Project 2 requires an investment of £30,000. Cash revenues and cash costs for each project are shown below.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

Required:

a.

Determine the net present value of EACH project using a 16 percent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

Definitions:

Import Quota

A government-imposed limit on the amount or value of goods that can be imported into a country.

International Bartering

The exchange of goods or services between parties from different countries without using money.

Countertrade

A form of international trade in which goods or services are exchanged for other goods or services, rather than for cash.

Less-Developed Country

A country characterized by low levels of industrialization, socioeconomic development, and often a low standard of living among its population.

Q2: If activity-based costing is used, electricity usage

Q14: An unfavorable materials price variance may be

Q16: Gerald Company manufactures books. Manufacturing a book

Q32: The labour efficiency variance is calculated as<br>A)

Q45: Describe an activity-based budget.

Q48: Discuss the limitation of profit measurement.

Q69: Products might consume overhead in different proportions

Q95: Barker Production Company has developed the following

Q99: Brown, Inc., has budgeted £60,000 for annual

Q104: Flexible resources<br>A) are supplied as needed.<br>B) are