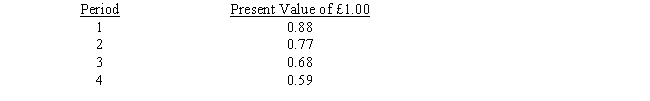

Redding Industries is considering the acquisition of a new machine that would reduce operating costs by £100,000 per year throughout its life. The machine has a cost of £300,000 and has an expected salvage value of £25,000 at the end of 4 years. The tax shield (i.e. tax savings) from capital allowances is £34,000; £45,344; £15,111; and £7,555 for Years 1-4, respectively. The company is at the 34 percent tax rate. The present value factors at the company's required rate of return are as follows:

Required: (Round all calculations to the nearest dollar.)

a.

Compute the after-tax operating cost savings per year.

b.

Determine the tax cost or tax savings related to the sale of the machine at the end of its useful life.

c.

Prepare a schedule computing the net present value of Redding Industries' investment in the machine.

Definitions:

Contract

A legally binding agreement between two or more parties that is enforceable by law.

Court of International Trade

The Court of International Trade is a federal court in the United States that deals with cases involving international trade and customs laws.

Worldwide Jurisdiction

The assertion of legal authority to prosecute or impose legal judgments regardless of geographical boundaries.

International Trade

The exchange of goods and services between countries, vital for the global economy, driven by comparative advantage, and subject to regulations and tariffs.

Q11: A(n) _ is a collection of overhead

Q26: Why do the NPV method and the

Q36: At a price of £32, the estimated

Q46: Anderson Company manufactures a variety of toys

Q47: Product costs can be distorted if a

Q48: Houston Corporation is considering an investment in

Q51: Refer to Figure 5. Ebola's variable overhead

Q67: Mertz, SA., has done a cost analysis

Q75: Taylor Company's budgeted sales were 10,000 units

Q80: Reggie Ltd. manufactures a single product with