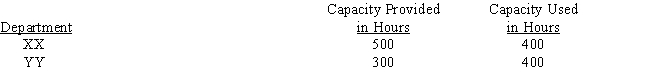

A company incurred £120,000 of common fixed costs and £180,000 of common variable costs. These costs are to be allocated to Departments XX and YY. Data on capacity provided and capacity used are as follows: Assume that common fixed costs are to be allocated to Departments XX and YY on the basis of capacity provided and that common variable costs are to be allocated to Departments XX and YY on the basis of capacity used. The fixed and variable costs allocated to Department XX are

Definitions:

Standard of Living

The level of wealth, comfort, material goods, and necessities available to a person or community.

Inflation Rate

The progression speed at which the cost of general goods and services increases, diminishing buying power over time.

Consumer Price Index

A metric tracking the average evolution over time in the expenditure of urban consumers on a designated selection of consumer goods and services.

Base Year

A specific year against which economic variables are measured and compared in indices or other economic calculations.

Q8: Refer to Figure 5 above. Return on

Q18: Armati, SA., is looking for feedback on

Q23: Winter Manufacturing has four categories of overhead.

Q47: Zipp Company manufactures two products (X and

Q47: Rydingsward, Inc., has done a cost analysis

Q47: Assuming all other things are the same,

Q56: The following standard costs were developed for

Q65: An equipment lease that specifies a payment

Q82: The functional-based responsibility accounting model is appropriate

Q114: Which of the following items would NOT