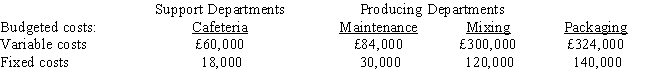

Crow Company applies factory overhead in its two producing departments using a predetermined rate based on budgeted machine hours in the Mixing Department and based on budgeted labour hours in the Packaging Department. Variable cafeteria costs are allocated to the producing departments based on budgeted number of employees, and fixed costs are allocated based on the capacity number of employees. Variable maintenance costs are allocated on the budgeted number of direct labour hours, and fixed costs are allocated on labour hour capacity. The data concerning next year's operations are as follows:

Required:

Required:

a.

Prepare a schedule showing the allocation of budgeted support department costs to producing departments.

b.

Determine the predetermined overhead rate for the producing departments.

Definitions:

RRSP

Registered Retirement Savings Plan, a Canadian account for holding savings and investment assets, with tax benefits for retirement savings.

Annuity

A fiscal vehicle offering a steady payout to individuals, commonly employed in retirement strategy.

Payments

The act of transferring money from one party to another, often in exchange for goods, services, or to fulfill a legal obligation.

Compounded Quarterly

Interest added to the principal sum every quarter, or four times a year, resulting in the interest of the next period being calculated on the new total.

Q12: Refer to Figure 2. What will Chott's

Q13: Miller Company produces speakers for home stereo

Q44: Which of the following statements is TRUE

Q53: In a traditional manufacturing company, product costs

Q56: Economic value added (EVA) is<br>A) a monetary

Q59: When a firm acquires the resources needed

Q69: Products might consume overhead in different proportions

Q78: A firm has £1,000,000 of long-term bonds

Q104: Rydingsward, Inc., has done a cost analysis

Q111: Cost-Volume-Profit analysis is subject to a number