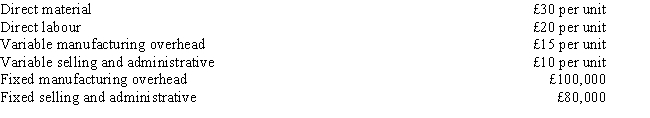

Mattingly Ltd. sells a single product for £150 per unit. Total sales were 6,000 units. The company is considering a 10 percent price reduction in order to stay competitive. It is estimated that such a reduction will increase sales volume by 10 percent. Assume a 40 percent tax rate. Costs are budgeted as follows:

Required:

Prepare a budgeted income statement for next year assuming that the company reduces prices as planned.

Definitions:

Dominant Strategy

In game theory, a strategy that is best for a player regardless of the strategies chosen by other players.

Reward/Risk Ratio

A metric used to compare the potential returns of an investment to its potential losses.

Expected Return

The anticipated return on an investment, based on historical data or probabilistic estimates of future performance.

Nonsystematic Variance

The portion of an investment's variance that is due to factors specific to its issuer and not related to wider market movements.

Q13: When cost-based pricing is employed and markup

Q20: Answer the following:<br>a. Discuss each of the

Q42: In a negotiated transfer price,<br>A) market prices

Q55: A company incurred £20,000 of common fixed

Q63: At the beginning of the year, Grant

Q74: Refer to Figure 1 above. How much

Q74: Refer to Figure 5. Ebola's labour rate

Q88: Compare and contrast functional-based, activity-based, and strategic-based

Q92: The sales price variance is created by

Q107: JIT avoids shutdowns due to materials shortages