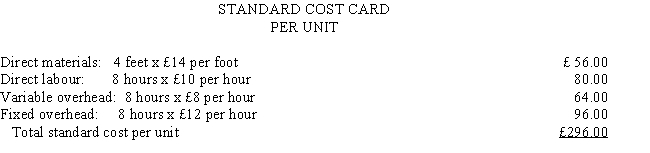

The following standard costs were developed for one of the products of CH Industries:

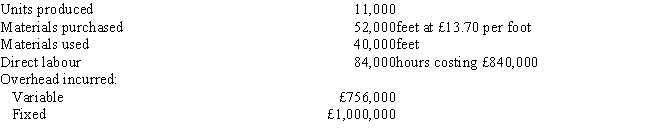

The following information is available regarding the company's operations for the period:

Budgeted fixed overhead for the period is £960,000, and the standard fixed overhead rate is based on an expected capacity of 80,000 direct labour hours.

Budgeted fixed overhead for the period is £960,000, and the standard fixed overhead rate is based on an expected capacity of 80,000 direct labour hours.

Required:

a.

Calculate the materials price variance and indicate whether it is favorable or unfavorable.

b.

Calculate the materials usage variance and indicate whether it is favorable or unfavorable.

c.

Calculate the labour rate variance and indicate whether it is favorable or unfavorable.

d.

Calculate the labour efficiency variance and indicate whether it is favorable or unfavorable.

e.

Calculate the variable overhead spending (expenditure)variance and indicate whether it is favorable or unfavorable.

f. Calculate the variable overhead efficiency variance and indicate whether it is favorable or unfavorable.

g. Calculate the fixed overhead spending (expenditure) variance and indicate whether it is favorable or unfavorable.

Definitions:

Investment in Stanton Inc.

The total financial outlay made by an entity to purchase shares or a stake in Stanton Inc., reflecting an investment decision.

Consolidated Income Statement

A financial statement that combines the income statements of a parent company and its subsidiaries.

Non-Controlling Interests

The portion of equity in a subsidiary not attributable directly or indirectly to the parent company.

Controlling Interest

A situation where a shareholder, or a group acting in kind, holds a majority of a company's stock, giving them significant control over its operations.

Q1: Bernie Manufacturing Company has two divisions, X

Q5: If activity-based costing is used, modifications made

Q38: Armati, SA., is looking for feedback on

Q43: O'Neil Company requires a return on capital

Q49: Bronco Company sells a product for £10.

Q87: Ernest, SA., has identified the following overhead

Q93: Setup time for a product is 12

Q107: Compare and contrast the incremental budgetary approach

Q115: Activity-based management attempts to<br>A) identify and eliminate

Q117: The following budget estimates have been prepared