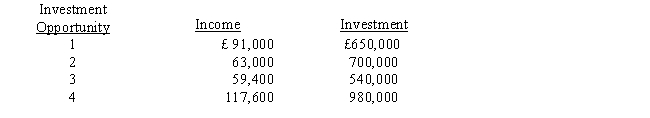

The manager of the recently formed Oak Division of Parkes, Incorporated, is evaluating the following four investment opportunities available to the division. Parkes, Incorporated, requires a minimum return of 10 percent.

Required:

a.

Calculate the return on investment (ROI) for each investment opportunity.

b.

If only one investment opportunity can be funded and the division is evaluated based on ROI, which investment opportunity would be accepted?

c.

If Parkes, Incorporated, can fund all of the projects and wishes to achieve the best possible performance, which investments would be accepted?

Definitions:

Equity

The principle of fairness in treatment and opportunity, which seeks to address disparities in social, economic, and political spheres.

Secondary Education

The stage of education following primary education, usually provided in high schools, vocational schools, and colleges, preparing students for college, vocational training, or direct entry into employment.

Stereotype Threat

The risk of confirming negative stereotypes about one's social group, which can negatively impact performance and behavior.

Affirmative Action

Policies and practices within organizations designed to promote opportunities for historically socio-politically disadvantaged groups.

Q8: Jilt,a non-U.S.corporation,not resident in a treaty country,operates

Q23: U.S.income tax treaties:<br>A)Provide rules by which multinational

Q42: Amber,Inc. ,a domestic corporation receives a $150,000

Q53: Rydingsward, Inc., has done a cost analysis

Q55: Refer to Figure 6 above. The Jones

Q65: An example of a nonunit-level driver is<br>A)

Q87: Costs incurred because products or services fail

Q99: The activity-based approach to break-even costing emphasizes<br>A)

Q119: Expenditures for discretionary fixed costs are frequently

Q144: The transfer of the assets of a