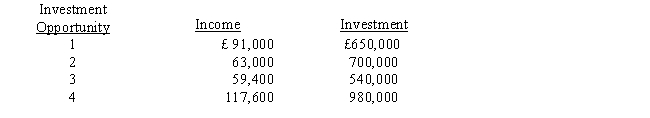

The manager of the recently formed Oak Division of Parkes, Incorporated, is evaluating the following four investment opportunities available to the division. Parkes, Incorporated, requires a minimum return of 10 percent.

Required:

a.

Calculate the return on investment (ROI) for each investment opportunity.

b.

If only one investment opportunity can be funded and the division is evaluated based on ROI, which investment opportunity would be accepted?

c.

If Parkes, Incorporated, can fund all of the projects and wishes to achieve the best possible performance, which investments would be accepted?

Definitions:

Net Useful Energy

The amount of energy available for use after subtracting the energy lost during generation, transmission, and conversion.

Subsurface Mining

A method of extracting minerals and ores from beneath the earth's surface, as opposed to open-pit or surface mining, often requiring tunnels or shafts.

Disease

A disorder of structure or function in a living organism that typically leads to signs or symptoms and is not a direct result of physical injury.

Groundwater Supplies

Underground sources of fresh water stored in aquifers, crucial for drinking water, irrigation, and industrial uses.

Q34: The costs of a consumer complaint department

Q51: Continuous budgeting requires managers to<br>A) add a

Q69: Refer to Figure 7. Orient's variable overhead

Q71: Refer to Figure 4. If Wheat Manufacturing

Q72: Which of the following items would be

Q106: Hunter Company manufactures two products (XX and

Q112: Which of the following appears in the

Q114: Describe and diagram the timeline that most

Q121: Which of the following is NOT an

Q123: USCo,a domestic corporation,reports worldwide taxable income of