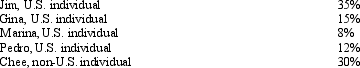

The following persons own Schlecht Corporation,a foreign corporation.  None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

Definitions:

Buying Division

A segment within a company responsible for purchasing goods, materials, and services from external suppliers.

Transfer Prices

Prices used for the sale of goods or services between departments or subsidiaries within the same company, often set to comply with tax laws.

Multinational Company

A corporation that operates in multiple countries beyond its home country, typically having a centralized headquarters but decentralized operations.

Tax Rates

The fraction of earnings taken as tax from a person or corporation by the authorities.

Q2: Refer to Figure 3 above. If you

Q4: Profit centre managers would be evaluated based

Q6: When a member departs a consolidated group,it

Q28: The Kelly Division of Zimmer Company sells

Q36: Refer to Figure 4. The maximum transfer

Q42: In a negotiated transfer price,<br>A) market prices

Q64: Which of the following statements regarding the

Q70: Discuss the primary purposes of income tax

Q87: A 5 percent wage increase for all

Q89: Provide an example as to how traditional