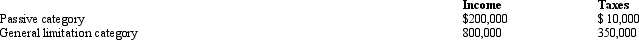

Britta,Inc. ,a U.S.corporation,reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Q20: Explain why it is important for the

Q23: U.S.income tax treaties:<br>A)Provide rules by which multinational

Q38: In the current year,Dove Corporation (E &

Q44: Stacey and Andrew each own one-half of

Q54: Which of the following is an incorrect

Q67: Lucinda owns 1,100 shares of Blackbird Corporation

Q77: A distribution from a corporation will be

Q116: When both apply,the § 382 NOL limitation

Q128: A company keeps 15 days of materials

Q145: Present,Inc. ,a domestic corporation,owns 60% of the