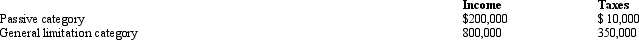

Britta,Inc. ,a U.S.corporation,reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Market Rate of Return

The average rate of return expected by investors from a market or security index over a specific time period.

CAPM

Stands for the Capital Asset Pricing Model, a model that describes the relationship between the expected return of an asset and its risk.

Liquidity

The ease with which an asset can be converted into cash without significantly affecting its price.

Trading Costs

Expenses associated with the buying and selling of securities, including commissions, spreads, and slippage.

Q1: Which of the following statements concerning the

Q17: The related-party loss limitation in a complete

Q39: For purposes of the § 338 election,a

Q51: The IRS can use § 482 reallocations

Q59: Interest paid to an unrelated party by

Q64: ParentCo's separate taxable income was $200,000,and JuniorCo's

Q86: Cash distributions received from a corporation with

Q90: Where are the controlling Federal income tax

Q119: ParentCo and SubCo had the following items

Q143: A U.S.business conducts international communications activities between