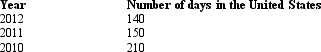

Given the following information,determine whether Greta,an alien,is a U.S.resident for 2012.Assume that Greta cannot establish a tax home in or a closer connection to a foreign country.

Definitions:

Discount Period

The timeframe in which a discount is offered for early payment of invoices, encouraging quicker payment from buyers.

Inventory Shrinkage

The loss of products between acquisition and sale, often due to theft, damage, or errors in counting.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditures to the period in which they actually occurred.

Perpetual Inventory Records

The continuous tracking of inventory levels and updates in real-time, showing the quantity of inventory on hand at all times.

Q2: The majority of the product cost is

Q8: Three years ago,Darlene received preferred (§ 306)stock

Q9: Mr. Baker, a divisional manager, is compensated

Q13: On January 1,Gold Corporation (a calendar year

Q16: A transfer pricing system should satisfy which

Q63: Income tax treaties may provide for either

Q75: Return on investment (ROI) is calculated as<br>A)

Q112: Ivory Corporation (E & P of $650,000)has

Q117: In 2013,George renounces his U.S.citizenship and moves

Q125: Product life-cycle costs do NOT include which