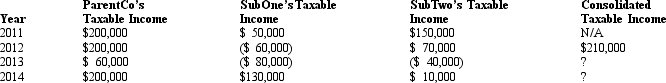

ParentCo,SubOne and SubTwo have filed consolidated returns since 2012.All of the entities were incorporated in 2011.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  How should the 2013 consolidated net operating loss be apportioned among the group members?

How should the 2013 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Ages of Jockeys

The specific years or the range in years that represents the age of individuals who professionally ride horses in races.

Interpretation

The process of explaining or finding the meaning of something, often applied to data, text, and observations.

Coefficient of Correlation

A statistic that measures the degree to which two variables are linearly related, with values ranging from -1 to 1.

Dependent Variable

The variable in an experiment that is expected to change in response to manipulations of the independent variable.

Q21: Gold and Bronze elect to form a

Q23: The demand-pull system requires goods to be

Q29: Sam's gross estate includes stock in Tern

Q35: Kirby and Helen form Red Corporation.Kirby transfers

Q57: The stock in Tangerine Corporation is held

Q62: Carmen and Carlos form White Corporation.Carmen transfers

Q83: One advantage of acquiring a corporation via

Q94: Assume that all of the affiliates in

Q95: Burl Corporation has assets with a value

Q148: When a business taxpayer "goes international," the