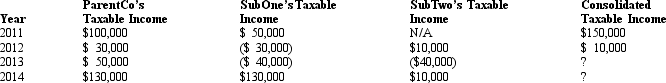

ParentCo and SubOne have filed consolidated returns since 2010.SubTwo was formed in 2012 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Subscription Price

The price at which existing shareholders can purchase new shares before they are offered to the public, often during a rights issue.

Rights Offering

A proposition by a company to its existing shareholders to purchase additional shares at a discounted price before the company offers it to the public.

Market Price

The current monetary value assigned to buying or selling assets or services in a marketplace.

Rights Offering

A type of financial offering in which a company gives its existing shareholders the right to buy additional shares at a discounted price before the public.

Q10: The calendar year Sterling Group files its

Q19: Noncorporate shareholders may elect out of §

Q20: Cooper Corporation joined the Duck consolidated Federal

Q22: Peanut,Inc. ,a domestic corporation,receives $500,000 of foreign-source

Q53: For purposes of the application of §

Q54: Which of the following is an incorrect

Q57: As part of a § 351 transfer,a

Q72: Puce Corporation,an accrual basis taxpayer,has struggled to

Q92: The calendar year parent and affiliates must

Q115: Without evidence to the contrary,the IRS views