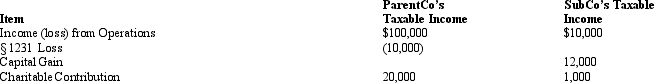

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

Definitions:

Fee

A payment made to a professional or an organization in exchange for services or advice.

Covenant

A formal, written agreement or promise between two or more parties, often featuring in contracts or real estate transactions.

Discharge

In legal terms, the release or extinguishment of an obligation, debt, or charge.

Collateral Mortgage

A type of mortgage where the borrower provides collateral other than the purchased property to secure the loan.

Q2: The two "Type A" reorganizations are mergers

Q3: Unlike tangible products, services have the characteristic

Q5: Ethel,Hannah,and Samuel,unrelated individuals,own the stock in Broadbill

Q5: Carl and Ben form Eagle Corporation.Carl transfers

Q29: The industrial value-chain analysis<br>A) recognizes only complex

Q40: The opportunity cost approach to setting a

Q74: Adam transfers cash of $300,000 and land

Q107: An example of an intercompany transaction is

Q123: Business reasons,and not tax incentives,constitute the primary

Q138: How are the members of a Federal