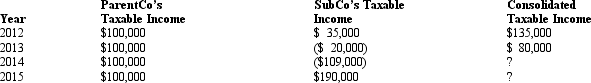

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2012.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  The 2014 consolidated loss:

The 2014 consolidated loss:

Definitions:

Course Of Performance

The history of dealings between the parties in the particular contract at issue.

Perfect Tender Rule

A legal principle that requires goods delivered under a sales contract to exactly meet the specifications agreed upon.

Buyer/Lessee

The individual or entity that purchases or leases goods or property.

Breach

The action of violating or not adhering to a rule, contract, or ethical guideline.

Q1: At the beginning of the year, Andrew

Q6: The United States has in force income

Q28: In computing consolidated taxable income,compensation amounts are

Q54: Angus Corporation purchased 15% of Hereford Corporation

Q70: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q85: Most of the Federal consolidated income tax

Q92: Refer to Figure 1. Sammie's actual cycle

Q111: The sound business purpose doctrine and §

Q124: Grayson, SA., has developed ideal standards for

Q137: At the beginning of the year, Grant