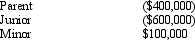

The Philstrom consolidated group reported the following taxable income amounts.Parent owns all of the stock of both Junior and Minor.Determine the net operating loss (NOL) that is apportioned to Parent.

Definitions:

Reward Power

The ability of an individual to influence others' behavior by controlling access to desired resources or rewards.

Coercive Power

The ability of a person to influence others' behavior by means of threats, punishment, or sanctions.

Legitimate Power

Power that is recognized as rightful or lawful, often derived from a position of authority or social structure.

Expert Power

The influence and authority a person has as a result of their expertise, skills, or knowledge.

Q6: Explain whether shareholders are exempted from gain/loss

Q17: If both §§ 357(b)and (c)apply to the

Q19: Members of the ABCD Federal consolidated group

Q22: In the current year,Warbler Corporation (E &

Q31: For consolidated tax return purposes,purchased goodwill is

Q34: The costs of a consumer complaint department

Q36: Brown Corporation,an accrual basis corporation,has taxable income

Q83: Ruth transfers property worth $200,000 (basis of

Q100: A consolidation is the union of two

Q143: Which of the following is NOT a