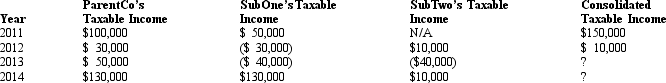

ParentCo and SubOne have filed consolidated returns since 2010.SubTwo was formed in 2012 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Extensive Training

Comprehensive and in-depth instruction or preparation designed to equip individuals with knowledge, skills, or competencies in a specific area.

Cross-Cultural

Pertaining to or comparing different cultures or the cultural differences, aimed at understanding diverse perspectives and behaviors.

Age-Related Concerns

Issues or challenges that become increasingly prominent or specific as individuals age, often relating to health, cognitive function, or social roles.

Apperceptive Personality Test

A type of psychological test that involves interpreting ambiguous stimuli, often used to uncover underlying thought patterns, feelings, and desires.

Q9: Miggs Manufacturing has one plant located in

Q21: Richards, SA., manufactures a product that experiences

Q41: The Philstrom consolidated group reported the following

Q61: An S corporation cannot take advantage of

Q70: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q70: Discuss the primary purposes of income tax

Q78: GreenCo transfers $400,000 of its common voting

Q116: Which of the following situations requires the

Q139: Larry Ltd.has developed ideal standards for four

Q140: The purpose of trend reporting on nonvalue-added