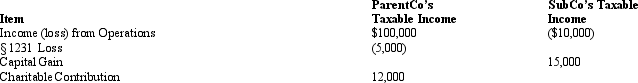

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

Definitions:

Parent Ownership Interest

The portion of equity interest in a subsidiary that is directly or indirectly owned by the parent company.

Cross-shareholdings

A situation where companies hold shares in other companies as part of their investment portfolio.

Corporations Act

Legislation that governs the operation and regulation of companies within a certain jurisdiction, detailing the legal requirements for company formation, operation, and dissolution.

Consolidated Statement

A financial statement that aggregates the financial performance and position of a parent company and its subsidiaries.

Q8: Jilt,a non-U.S.corporation,not resident in a treaty country,operates

Q27: Lacking elections to the contrary,Federal consolidated NOLs

Q28: In computing consolidated taxable income,compensation amounts are

Q37: Lupe and Rodrigo,father and son,each own 50%

Q40: A Qualified Business Unit of a U.S.corporation

Q48: Obtaining a positive letter ruling from the

Q51: In comparison to a traditional environment, a

Q61: An S corporation cannot take advantage of

Q121: SubCo sells an asset to ParentCo at

Q134: If subsidiary stock is redeemed or sold