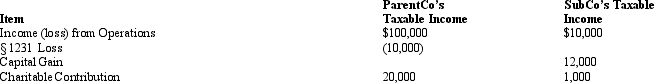

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

Definitions:

Noncurrent Assets

Long-term investments or properties that a company doesn't expect to convert into cash within one year.

Contractual Agreements

Contractual agreements are legally binding arrangements between two or more parties outlining the terms, conditions, and obligations of each.

Financial Statement Disclosure

Requirement to provide comprehensive information within financial statements, ensuring transparency and aiding stakeholders in decision-making.

Gross Profit Percentage

A financial metric expressing gross profit as a percentage of total sales.

Q2: On January 1,Gull Corporation (a calendar year

Q33: Starling Corporation has accumulated E & P

Q40: Abel owns all the stock of both

Q49: Egret Corporation has manufactured recreational vehicles for

Q64: Which of the following process dimensions of

Q73: The DPAD cannot exceed 60% of the

Q81: The penalty taxes of § 531 and

Q84: On January 2,2012,Orange Corporation purchased equipment for

Q92: Refer to Figure 1. Sammie's actual cycle

Q95: Using the abbreviations listed below, indicate for