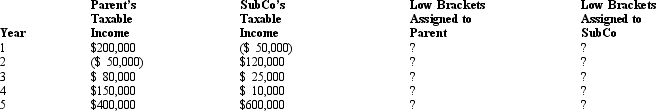

Parent Corporation owns 100% of the stock of SubCo,and the two corporations file a consolidated tax return.Over a five-year period,the corporations generate the following taxable income/(loss).Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income.Explain the rationale for your recommendation.

Definitions:

Bond

A financial tool signifying a loan from an investor to a borrower, usually from a company or government, that generates a consistent revenue.

Relative Purchasing Power Parity

An economic theory that states that exchange rates between currencies are in equilibrium when their purchasing power is the same in each of the two countries.

Expected Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling, as anticipated by consumers.

Exchange Rate

The rate at which one currency can be exchanged for another currency.

Q10: Dawn,a sole proprietor,was engaged in a service

Q17: The Long Corporation has $500,000 of assets

Q21: In the case of corporations that are

Q32: _ are outcome measures that can be

Q68: Maria and Christopher each own 50% of

Q84: Ann transferred land worth $500,000,with a tax

Q91: ParentCo's controlled group includes the following members.ParentCo

Q105: Which of the following entities is eligible

Q124: Grayson, SA., has developed ideal standards for

Q145: For each activity listed below, determine the