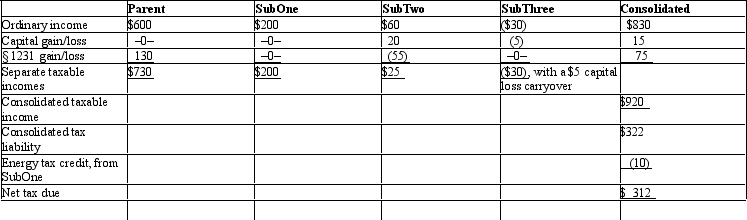

The Parent consolidated group reports the following results for the tax year.Determine each member's share of the consolidated tax liability,assuming that the members all have consented to use the relative tax liability tax-sharing method.Dollar amounts are listed in millions,and a 35% marginal income tax rate applies to all of the entities.

Definitions:

Policies and Rules

Established guidelines and regulations designed to govern the conduct, procedures, and operations within an organization.

Procedural Justice

The fairness of the processes that resolve disputes and allocate resources, emphasizing transparency, consistency, and impartiality.

Sexual Harassment Allegations

Claims made by individuals regarding unwelcome sexual advances, requests for sexual favors, and other verbal or physical harassment of a sexual nature.

Top Management

The highest level of management in an organization, responsible for setting strategic goals and making overarching decisions.

Q1: Bernie Manufacturing Company has two divisions, X

Q10: The "residence of seller" rule is used

Q20: Explain why it is important for the

Q50: Craig, SA., sells one of its products

Q73: The DPAD cannot exceed 60% of the

Q74: Five years ago,Eleanor transferred property she had

Q81: Costs incurred because products or services fail

Q97: Intangible drilling costs are a tax preference

Q100: A consolidation is the union of two

Q122: At the beginning of the year, Andrew