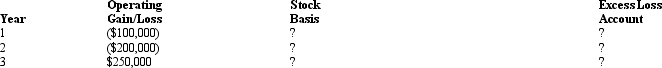

Calendar year Parent Corporation acquired all of the stock of SubCo on January 1,Year 1,for $400,000.The subsidiary's operating gains and losses are shown below.In addition,a $30,000 dividend is paid early in Year 2.

Complete the following chart,indicating the appropriate stock basis and excess loss account amounts.

Definitions:

Q3: Refer to Figure 6 above. Assume the

Q7: ForCo,a foreign corporation,receives interest income of $100,000

Q8: A time-and-motion study revealed that it should

Q13: In connection with the construction of a

Q19: Stephanie is the sole shareholder and president

Q42: Purple Corporation has accumulated E & P

Q51: Netting refers to the process of AMT

Q68: Which of the following persons typically is

Q70: Which of the following statements is true

Q86: Cash distributions received from a corporation with