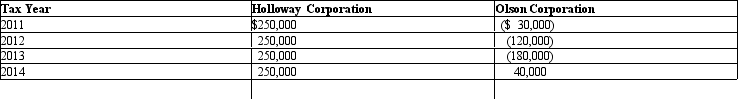

Compute consolidated taxable income for the calendar year Holloway Group,which elected consolidated status immediately upon creation of the two member corporations in January 2011.All recognized income related to the data processing services of the firms.No intercompany transactions were completed during the indicated years.

Definitions:

Turnover

The rate at which employees leave a company and are replaced, which can indicate the organization's health and work environment.

Minority Group Members

Individuals who belong to a group that experiences a lesser degree of power, social prestige, or privilege compared to the dominant groups in a society.

Uncertainty Avoidance

As a cultural value, the extent to which members of a society rely (and should rely) on social norms, rules, and procedures to lessen the unpredictability of future events.

Procedures

Procedures are established methods or sequences of actions for performing a task or solving a problem systematically.

Q3: Jokerz,a CFC of a U.S.parent,generated $80,000 of

Q6: Explain whether shareholders are exempted from gain/loss

Q24: A tax haven often is:<br>A)A country with

Q26: Outline the major advantages and disadvantages of

Q51: Tina incorporates her sole proprietorship with assets

Q89: When computing current E & P,taxable income

Q93: A city contributes $500,000 to a corporation

Q95: The Harris consolidated group reports a net

Q112: ParentCo owned 100% of SubCo for the

Q147: Warranty work is a(n)<br>A) prevention cost<br>B) appraisal