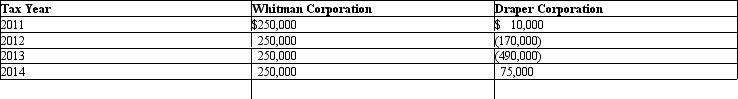

Compute consolidated taxable income for the calendar year Whitman Group,which elected consolidated status immediately upon creation of the two member corporations in January 2011.All recognized income related to the data processing services of the firms.No intercompany transactions were completed during the indicated years.

Definitions:

Lack of Reflexes

A condition characterized by the absence or significant decrease of reflex actions, which could indicate neurological problems.

Cyanotic

Pertaining to bluish or purplish discoloration of the skin and mucous membranes due to insufficient oxygen in the blood.

Cognitive Development

The process of growth and change in intellectual/mental abilities such as learning, attention, memory, language, thinking, reasoning, and creativity.

Psychosocial Development

The domain of lifespan development that examines emotions, personality, and social relationships.

Q15: In a Federal consolidated tax return group,who

Q40: Which of the following is NOT a

Q47: Consolidated estimated tax payments must begin for

Q59: labour and overhead incurred for rework of

Q79: In certain circumstances,the amount of dividend income

Q91: _ decreases the time and resources required

Q98: On April 7,2011,Crow Corporation acquired land in

Q105: Winner Corporation acquires all of Loser Corporation

Q117: _ are the results or products of

Q142: In 2004, Shelby Foods instituted a quality