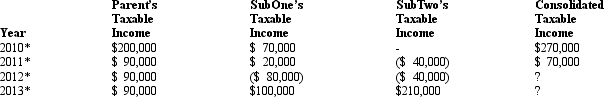

The group of Parent Corporation,SubOne,and SubTwo has filed a consolidated return since 2011.The first two entities were incorporated in 2010,and SubTwo came into existence in 2011 through an asset spin-off from Parent.Taxable income computations for the members are shown below.None of the group members incurred any capital gain or loss transactions during 2010-2013,nor did they make any charitable contributions.

Describe the treatment of the group's 2012 consolidated NOL.Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Definitions:

Simplest Form

Refers to the state of an algebraic expression when it has been reduced to the most basic or simplified version without changing its value.

Reciprocal

The inverse of a number or expression; for a nonzero number \(x\), its reciprocal is \(1/x\).

Simplest Form

A term used to describe an expression, fraction, or other mathematical entity that has been reduced to its most basic form, eliminating any common factors or simplifying variables.

Repeated Addition

Repeated addition is the process of adding the same number multiple times, which is a foundational principle behind multiplication.

Q4: A shareholder's holding period for stock received

Q26: Which of the following is not a

Q28: Dick,a cash basis taxpayer,incorporates his sole proprietorship.He

Q54: Isabella and Marta form Pine Corporation.Isabella transfers

Q69: A "Type A" reorganization that is the

Q77: The adjusted gross estate of Keith,decedent,is $6

Q82: At the beginning of the year, Bing

Q86: _ are those activities necessary to remain

Q109: Section 332 does not apply to a

Q123: USCo,a domestic corporation,reports worldwide taxable income of