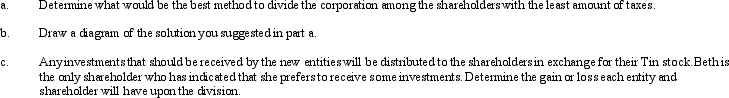

Tin Corporation was created 10 years ago.It currently is valued at $1.5 million as follows: Tacks division ($420,000),Safety Pins division ($580,000),Paper Clips division ($450,000)and investment assets ($50,000).Tin currently has three shareholders: Antonio,who was the initial shareholder and now owns 40% of the stock (basis in stock $350,000),and Beth and Chang,who each purchased 30% of Tin two years ago for $435,000.

Tin is having management problems because the shareholders cannot agree on the future of the company.They have determined that it would be best to divide up the company and go their separate ways.Each shareholder feels that the others do not deserve to continue using the Tin Corporation name.

Definitions:

Expected Rate

The anticipated return on an investment over a specific period.

Standard Deviation

A statistical measure that quantifies the variation or dispersion of a set of numerical data from its mean.

Zero Standard Deviation

A statistical measure indicating that all values within a data set are identical.

Risk-Free Asset

A financial instrument that is considered to have no risk of financial loss, typically government bonds.

Q1: Hannah,Greta,and Winston own the stock in Redpoll

Q10: The "residence of seller" rule is used

Q13: Magdala is a citizen of Italy and

Q21: Richards, SA., manufactures a product that experiences

Q26: Estates and trusts can claim Federal income

Q28: _ are relationships among activities that are

Q43: Sarah and Tony (mother and son)form Dove

Q62: Which statement is false?<br>A)The overall tax effect

Q80: A transferor who receives stock for both

Q85: ScottishCo is owned by Gordon Bryson and