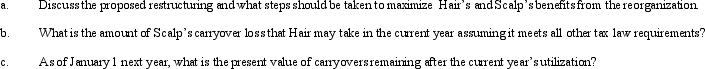

Present Value Tables needed for this question.Hair Corporation would like to acquire Scalp Corporation on August 31 because Scalp has an $8,000 capital loss carryover and $32,200 of general business credits that Hair could readily use.At this time,Scalp has assets valued at $1 million (basis of $1.1 million).While Hair is not interested in having Scalp's shareholders become its shareholders,it is interested in expanding into Scalp's business line.Hair thinks it could turn Scalp around with up-to-date equipment.Thus,Hair would like to sell Scalp's assets immediately,recognize the loss to offset its expected gains,and then use the proceeds to purchase new equipment.Hair is a very profitable corporation and is also expecting to have at least $50,000 of capital gains and $3 million in other income for the current year.Hair is proposing paying cash for all of Scalp's assets and liabilities.The Federal long-term tax-exempt rate is currently 3%,and Hair's discount factor for making investment decisions is 15%.

Definitions:

Plain English

Writing or speaking in clear, straightforward language devoid of complex vocabulary or jargon, making it easily understandable.

Clichés

Overused expressions or ideas that have lost their originality or impact due to excessive use.

Grammatical Errors

Grammatical errors are mistakes in the use of a language's grammar, such as incorrect verb tenses, misuse of prepositions, and subject-verb agreement errors.

Usage Errors

Mistakes made in the application or understanding of a language's rules, typically in grammar, syntax, or vocabulary.

Q7: DPGR - Allowable Indirect Costs = QPAI.Is

Q25: Dahlia owns $100,000 in Fuchsia bonds.The interest

Q33: In order to encourage the development of

Q37: Lupe and Rodrigo,father and son,each own 50%

Q58: A shareholder lends money to his corporation

Q77: A distribution from a corporation will be

Q88: The tax treatment of the parties involved

Q96: The year in which the ownership shift

Q96: At the time of her death,Janice owned

Q112: In allocating interest expense between U.S.and foreign