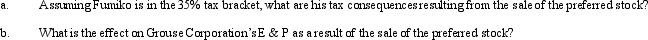

As of January 1 of the current year,Grouse Corporation has E & P of $600,000.Fumiko owns 320 shares of Grouse's common stock (basis of $45,000).On that date,Grouse Corporation declares and distributes a nontaxable preferred stock dividend,of which Fumiko receives 100 shares.Immediately after the stock dividend,the fair market value of one share of Grouse common stock is $500,and the fair market value of one share of Grouse preferred stock is $200.Two months later,Fumiko sells the 100 shares of preferred stock to an unrelated individual for $20,000.

Definitions:

Catchall Category

A broad classification used to encompass a wide range of items or concepts that do not fit neatly into specific categories.

Schizophrenia

A long-lasting and intense psychological condition marked by altered cognition, feeling, communication, identity, and conduct.

Hypochondriasis

A disorder characterized by an excessive preoccupation with and fear of having a serious illness, despite medical evaluation and reassurances.

Excessively

To a degree or extent that exceeds what is normal or permissible.

Q1: During 2012,Gold Corporation (a calendar year taxpayer)has

Q9: In 1916,the Supreme Court decided that corporate

Q27: Racket Corporation and Laocoon Corporation create Raccoon

Q45: Present Value Tables needed for this question.Sugar

Q45: Similar to like-kind exchanges,the receipt of "boot"

Q60: On January 1,Tulip Corporation (a calendar year

Q69: Trusts can select any fiscal Federal income

Q90: The gross estate of John,decedent,includes stock in

Q107: The adjusted gross estate of Debra,decedent,is $8

Q116: A single trust that is operated independently