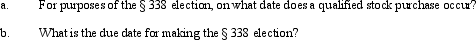

On March 16,2011,Blue Corporation purchased 10% of the Gold Corporation stock outstanding.Blue Corporation purchased an additional 40% of the stock in Gold on October 24,2011,and an additional 25% on April 4,2012.On July 23,2012,Blue Corporation purchased the remaining 25% of Gold Corporation stock outstanding.

Definitions:

Cash Short and Over

An account that stores any discrepancies between the expected cash count and the actual amount of cash present, reflecting errors or theft.

Other Income

Revenue generated from activities that are not part of a company's primary business operations, including interest, dividends, and gains from asset sales.

Income Statement

A financial report that shows a company's revenues, expenses, and profits over a specific period.

Separating Responsibilities

A risk management technique that involves dividing tasks and authorities among different individuals or groups to reduce the risk of error or fraud.

Q56: If a C corporation uses straight-line depreciation

Q57: As part of a § 351 transfer,a

Q64: Robin Corporation,a calendar year taxpayer,manufactures and sells

Q79: Nancy,Guy,and Rod form Goldfinch Corporation with the

Q79: The Yan Estate is your client,as are

Q100: May Corporation,a Miami contractor,pays Crane Engineering a

Q102: Liabilities generally are not considered boot in

Q107: On March 1,Cream Corporation transfers all of

Q111: An example of income in respect of

Q135: A U.S.corporation may be able to alleviate