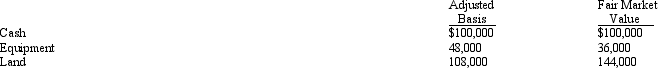

Kathleen transferred the following assets to Mockingbird Corporation.  In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

Definitions:

Adjusting Entry

A journal entry made in accounting records at the end of an accounting period to allocate income and expenditure to the appropriate periods.

Adjusting Entries

At the conclusion of an accounting cycle, entries are documented in the accounting ledger to distribute revenues and costs to the actual period they happened.

Types

Varieties or classifications into which objects, people, or concepts can be grouped based on shared characteristics.

Profit Margin Ratio

A financial metric used to evaluate a business's profitability by dividing net income by net sales.

Q3: The Chen Trust is required to distribute

Q7: Legal dissolution under state law is required

Q21: The receipt of nonqualified preferred stock in

Q32: In making gifts of property to family

Q66: In computing consolidated taxable income,capital gains and

Q68: Which of the following statements is true

Q72: Blue Company,a U.S.corporation based in Texas,manufactures and

Q77: Perry organized Cardinal Corporation 10 years ago

Q86: When Pheasant Corporation was formed under §

Q138: Jacob makes a gift of property (basis