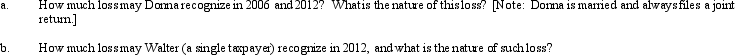

In 2005,Donna transferred assets (basis of $300,000 and fair market value of $250,000)to Egret Corporation in return for 200 shares of § 1244 stock.Due to § 351,the transfer was nontaxable;therefore,Donna's basis in the Egret stock is $300,000.In 2006,Donna sells 100 of these shares to Walter (a family friend)for $100,000.In 2012,Egret Corporation files for bankruptcy,and its stock becomes worthless.

Definitions:

Arraignment

An arraignment is a court proceeding where the defendant is formally charged and asked to respond to the charges by entering a plea.

Plea

A formal statement made by a defendant in court regarding their guilt or innocence concerning the charges against them.

Charges

Fees or prices asked for goods and services, or sums levied as penalties for breaking the law or conditions of a contract.

Recidivism

The tendency of a convicted criminal to reoffend.

Q4: Explain the requirements for the termination of

Q36: When substantially all of the assets of

Q38: If there is sufficient E & P,a

Q54: Angus Corporation purchased 15% of Hereford Corporation

Q60: In order to encourage the redevelopment of

Q67: Lucinda owns 1,100 shares of Blackbird Corporation

Q79: In certain circumstances,the amount of dividend income

Q89: In structuring the capitalization of a corporation,the

Q97: Intangible drilling costs are a tax preference

Q102: A shareholder's holding period of property acquired