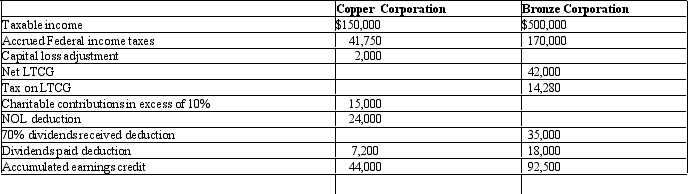

In each of the following independent situations,calculate accumulated taxable income,if any.Assume the corporation is not a mere holding or investment company.

Definitions:

Value of The Business

The estimated overall worth of a business, considering factors such as assets, earnings, market position, and future prospects.

Strength of Relationship

The degree of trust, mutual respect, and commitment between individuals or organizations in a business context.

Number of Years

A quantification of time in years, often used to measure durations such as age, experience, or timelines.

Potential Sales

The possible revenue that could be generated from selling products or services to interested customers.

Q18: Becky made taxable gifts in 1974,2010,and 2012.In

Q42: Kim,a resident and citizen of Korea,dies during

Q43: A small corporation with unused minimum tax

Q63: Samantha owns stock in Pigeon Corporation (basis

Q74: Which of the following statements is incorrect

Q90: Amy owns 20% of the stock of

Q97: During the current year,Shrike Company had $220,000

Q101: Norma formed Hyacinth Enterprises,a proprietorship,in 2012.In its

Q107: The adjusted gross estate of Debra,decedent,is $8

Q112: In which type of reorganization could bonds