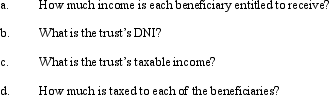

Counsell is a simple trust that correctly uses the calendar year for tax purposes.Its income beneficiaries (Kathie,Lynn,Mark,and Norelle)are entitled to the trust's annual accounting income in shares of one-fourth each.For the current calendar year,the trust has ordinary business income of $40,000,a long-term capital gain of $20,000 (allocable to corpus),and a trustee commission expense of $4,000 (allocable to corpus).Use the format of Figure 20.3 in the text to address the following items.

Definitions:

Contextual Variables

Factors that influence the performance and behavior of individuals or organizations, but exist outside of their direct control.

Firm's Competitive Advantage

The unique attributes or capabilities that enable a business to outperform its competitors and achieve superior margins.

Organizational Goals

The objectives or targets that an organization aims to achieve, which guide its strategic planning and operations.

Strategic Framework

An overarching plan or structure that outlines an organization's strategy, including its goals, principles, and approaches to achieving its objectives.

Q1: Hannah,Greta,and Winston own the stock in Redpoll

Q16: The taxpayer must pay a significant fee

Q36: Calvin's will passes $800,000 of cash to

Q50: A decedent's income in respect of a

Q57: Cole purchases land for $500,000 and transfers

Q64: Joe and Kay form Gull Corporation.Joe transfers

Q68: The election of § 2032 (alternate valuation

Q80: In comparing a qualifying stock redemption with

Q106: The DPAD is not allowed for AMT

Q107: A surviving spouse's share of the community