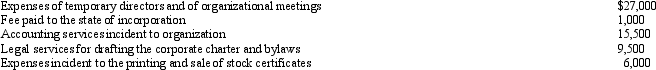

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2012.The following expenses were incurred during the first tax year (April 1 through December 31,2012) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Definitions:

Economic Efficiency

A condition where resources are allocated in a way that maximizes the production of goods and services.

Political Power

The authority or influence that individuals or groups hold within a political structure.

Sherman Act

An antitrust federal statute passed in 1890 which prohibits certain business activities that reduce competition in the marketplace, including monopolies.

Felony

A serious crime, such as murder, rape, or robbery, that is punishable by imprisonment for more than one year or death.

Q20: The Statements on Standards for Tax Services

Q25: The IRS is one of the largest

Q37: Thrush Corporation files Form 1120,which reports taxable

Q61: Yang,a calendar year taxpayer,did not file a

Q63: Eve transfers property (basis of $120,000 and

Q66: Compare the basic tax and nontax factors

Q78: Pheasant Corporation,a calendar year taxpayer,has $400,000 of

Q134: What is the justification for the terminable

Q147: The IRS targets high-income individuals for an

Q148: Whether an organization is a qualified charity