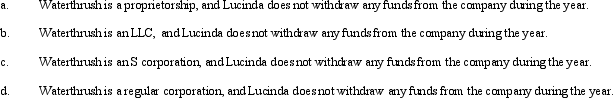

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Definitions:

Total Cost

The complete cost of production that includes both fixed and variable costs.

Opportunity Cost

The best alternative that we forgo, or give up, when we make a choice or a decision.

ΔTVC/Δq

ΔTVC/Δq represents the change in Total Variable Cost (TVC) resulting from producing one additional unit of output, equivalent to Marginal Cost.

AVC

AVC, or Average Variable Cost, is the total variable costs divided by the quantity of output produced.

Q6: In 2010,Pam makes a gift of land

Q14: Roughly five percent of all taxes paid

Q16: Wren Corporation (a minority shareholder in Lark

Q25: Which,if any,of the following is a correct

Q35: The IRS can require that the taxpayer

Q44: Mitchell and Powell form Green Corporation.Mitchell transfers

Q65: Because of the taxable income limitation,no dividends

Q97: During the current year,Shrike Company had $220,000

Q103: Beneficiary Terry received $30,000 from the Urgent

Q140: For gift tax purposes,a property settlement in