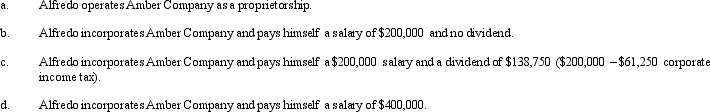

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations. )

Definitions:

Trigger Strategy

A long-term tactic in game theory where a player's future actions are conditional on other players' actions, commonly used to enforce cooperation or punish non-cooperation.

Equilibrium Efficiency

The optimal allocation of resources in a market where supply and demand are balanced, leading to the best possible outcome for both producers and consumers.

Utility

A measure of the satisfaction or benefit that consumers derive from consuming goods or services.

Nash Equilibrium

A concept in game theory where no player can benefit by changing strategies while the other players keep theirs unchanged.

Q4: A tax preparer can incur a penalty

Q5: Some of the meals a food service

Q8: During the current year,Goose Corporation sold equipment

Q12: The tax treatment of corporate distributions at

Q21: Grebe Corporation,a closely held corporation that is

Q50: In which,if any,of the following independent situations

Q60: Using his separate funds,Wilbur purchases an annuity

Q109: The Code defines a "simple trust" as

Q113: When a tax issue is taken to

Q113: Concerning the election to split gifts under