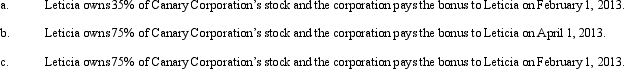

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2012,Canary has accrued a $75,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Sensitive Locations

Defined as places considered to require special protection or respect because of their cultural, environmental, or historical significance.

Court Order

A formal statement from a court that requires a person or entity to do or not do specific actions.

Religious Beliefs

The faith or conviction in the doctrines of a religion, which often guide the moral and ethical decisions of its followers.

Public Schools

Schools that are funded and run by the government, providing free education to children in the community.

Q9: To reduce trustee commissions,the Sigrid Trust is

Q10: One-fourth of the Cruger Estate's distributable net

Q13: According to AICPA rules,the CPA cannot take

Q21: Gadsden,who is subject to a 35% marginal

Q26: Estates and trusts can claim Federal income

Q37: Lyle and Beatrice are brother and sister.Using

Q41: Rosa,the sole shareholder of Robin Corporation,contributes land

Q64: Describe the various tax advantages that are

Q83: Ruth transfers property worth $200,000 (basis of

Q128: The tax rules regarding the income taxation