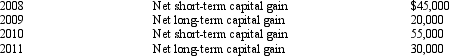

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

Definitions:

Financial Risk

The possibility of losing money on an investment or business venture; includes market risk, credit risk, liquidity risk, and operational risk, among others.

Shareholders

Individuals or entities that own shares in a corporation, granting them rights to dividends and a say in company affairs proportional to their shareholding.

ROCE

Return on Capital Employed, a financial metric that measures a company's profitability and the efficiency with which its capital is employed.

After-Tax Cost

The expense of an action or investment after accounting for the effects of taxes.

Q45: A calendar year C corporation with average

Q53: A corporation has the following items related

Q56: A discount for valuation purposes is allowed

Q66: The IRS can waive the penalty for

Q85: Politz Corporation has average gross receipts of

Q94: As of January 1,Cassowary Corporation has a

Q96: The rules used to determine the taxability

Q97: The dividends received deduction is added back

Q97: During the current year,Shrike Company had $220,000

Q125: Tax planning motivations usually are secondary to