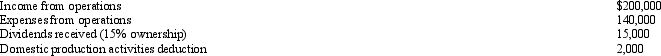

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Predetermined Overhead Rate

A rate determined prior to the start of a period, designed for assigning anticipated overhead expenses to products or job orders, utilizing a selected activity basis for calculation.

Manufacturing Overhead

Costs in the manufacturing process that are not direct labor or materials.

Direct Labor-Hours

A measure of the labor directly involved in manufacturing a product, expressed in hours.

Predetermined Overhead Rate

A pre-determined rate for distributing overhead expenses to products or job orders, calculated prior to the beginning of the period using projected costs and estimated levels of activity.

Q13: One of the reasons the estate tax

Q13: On January 1,Gold Corporation (a calendar year

Q64: Robin Corporation,a calendar year taxpayer,manufactures and sells

Q70: Penny,Miesha,and Sabrina transfer property to Owl Corporation

Q74: Which of the following statements is incorrect

Q89: A gift of installment notes causes any

Q92: Francisco is the sole owner of Rose

Q95: If stock rights are taxable,the recipient has

Q97: Kip and his wife Biddie file calendar-year

Q108: The corporate marginal income tax rates range