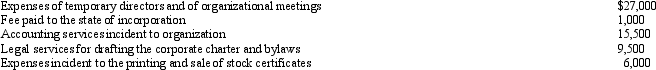

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2012.The following expenses were incurred during the first tax year (April 1 through December 31,2012) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Definitions:

Coconscious Relationship

Describes a relationship in which two or more consciousnesses or identities are aware of and can co-operate with each other, often used in the context of dissociative identity disorder.

Personalities

The characteristic patterns of thoughts, feelings, and behaviors that make a person unique and which influence how they interact with the world around them.

Psychodynamic Theories

A group of theories in psychology that emphasize the influence of the unconscious mind and childhood experiences on behavior and personality.

Dissociative Identity Disorder

A severe condition involving two or more distinct identities or personality states controlling a person's behavior at different times.

Q18: In computing the Federal taxable income of

Q20: Becky inherited property from her mother seven

Q23: In a § 351 transfer,a shareholder receives

Q32: Waldo is his mother's sole heir and

Q39: In determining the Federal gift tax on

Q47: The Raja Trust operates a welding business.Its

Q96: Which of the following is a typical

Q109: Carol inherits her father's farm,and the executor

Q151: Which of the following statements is incorrect

Q165: Which of the following statements relating to