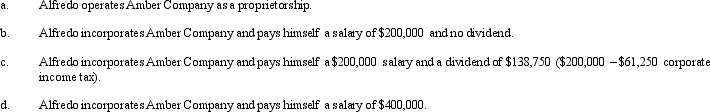

Amber Company has $400,000 in net income in 2012 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations. )

Definitions:

Aversive Events

Unpleasant or undesirable occurrences that individuals seek to avoid or minimize, often motivating behavior changes.

Behavioral Disengagement

A coping mechanism involving withdrawal from or reduction of effort in attempting to achieve goals when they seem unattainable.

Dropping Class

The act of formally removing oneself from an academic course during a specified period without academic penalty.

Coping Strategies

Methods or techniques used by individuals to manage and mitigate stress or difficult situations.

Q4: A tax preparer can incur a penalty

Q14: Red Corporation,which owns stock in Blue Corporation,had

Q44: Stacey and Andrew each own one-half of

Q61: Fred and Pearl always have lived in

Q73: The Taft Estate was established when Winnie

Q76: A farm has a best use valuation

Q77: Harry and Brenda are husband and wife.Using

Q91: On January 30,Juan receives a nontaxable distribution

Q96: A recapture of special use valuation will

Q159: For Federal estate tax purposes,the gross estate