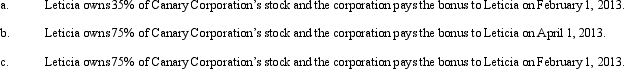

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2012,Canary has accrued a $75,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Family Violence

Acts of physical, sexual, or emotional abuse among members of a household, typically involving spouses or partners.

Domestic Violence

Physical, emotional, or psychological abuse within a household, often between intimate partners or family members.

Family Members

Individuals related by blood, marriage, or adoption who share a common domicile or are part of the same immediate social unit.

Mistreat

To treat someone or something badly, with cruelty or negligence.

Q18: Paula owns an insurance policy on her

Q56: A discount for valuation purposes is allowed

Q58: A shareholder lends money to his corporation

Q61: Yang,a calendar year taxpayer,did not file a

Q86: Which of the following statements is incorrect

Q88: When one spouse predeceases the other,the credit

Q112: Since the credit for state death taxes

Q120: Generally,property that passes to a surviving spouse

Q121: Which statement is correct concerning the rules

Q137: In an estate freeze,the common stock is