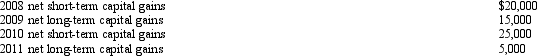

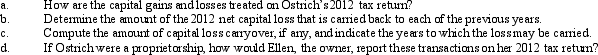

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Cancer

A disease characterized by the uncontrolled growth and spread of abnormal cells, which can form tumors and potentially lead to death if untreated.

Malignant Neoplasm

A cancerous tumor that invades surrounding tissues and has the potential to spread to distant body parts.

Malignant Cells

Abnormal and cancerous cells that have the potential to invade and destroy nearby tissue and spread to other parts of the body.

Verbal Cues

Non-physical signals used in communication, like tone of voice or speech pace, to convey or supplement meaning.

Q15: Before his nephew (Dean)leaves for college,Will loans

Q24: Robin Corporation distributes furniture (basis of $40,000;fair

Q55: If a transaction qualifies under § 351,any

Q73: A personal service corporation with taxable income

Q74: Adam transfers cash of $300,000 and land

Q79: Rachel owns an insurance policy on the

Q88: Tungsten Corporation,a calendar year cash basis taxpayer,made

Q94: If the taxpayer refuses to pay an

Q111: By his will,all of Rusty's property passes

Q131: In 1985,Drew creates a trust with $1,000,000