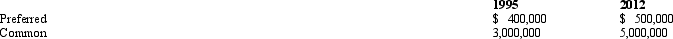

Dustin owns all of the stock of Gold Corporation which includes both common and preferred shares.The preferred stock is noncumulative,has no redemption date,and possesses no liquidation preference.In 1995,Dustin makes a gift to his adult children of all of the common stock.He dies in 2012 still owning the preferred stock.The value of the Gold stock on the relevant dates is:  One of the tax consequences of this estate freeze is:

One of the tax consequences of this estate freeze is:

Definitions:

Corticosteroids

A class of steroid hormones that are used in medicine to treat inflammation and other diseases by mimicking the effects of hormones produced by the adrenal glands.

Feeding Self-Care Deficit

A condition where an individual is unable to feed themselves without assistance due to physical or cognitive limitations.

Neuromuscular Hand

A term that may refer to conditions or disorders affecting the muscles and nerves of the hand, leading to impaired function. (Not a commonly used medical term, thus the definition is inferred.)

Adaptive Utensils

Specialized eating tools designed to help individuals with disabilities or mobility issues eat independently, enhancing grip and control.

Q11: A sole proprietor shows the DPAD as

Q20: Under the terms of a trust created

Q38: Grebe Corporation was formed in 2001.If in

Q47: In taking a dispute to the Appeals

Q50: On December 31,2012,Lavender,Inc. ,an accrual basis C

Q51: Valdez Corporation,a calendar-year taxpayer,owns property in States

Q102: The Zhao Estate generated distributable net income

Q103: The ACE adjustment can be positive or

Q128: If a state follows Federal income tax

Q132: Circular 230 requires that a tax preparer