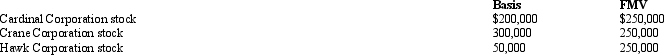

Eric,age 80,has accumulated about $6 million in net assets.Among his assets are the following marketable securities held as investments.  Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church.In addition,to consummate a land deal,he needs $250,000 in cash.Looking solely to tax: considerations and using only the assets described above,Eric's best choice is to:

Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church.In addition,to consummate a land deal,he needs $250,000 in cash.Looking solely to tax: considerations and using only the assets described above,Eric's best choice is to:

Definitions:

RUPA

stands for the Revised Uniform Partnership Act, which governs the operation of partnerships in the United States.

Winding Up

In partnership and corporation law, the orderly liquidation of the business’s assets.

Nonwrongful Dissociation

The act of separating oneself from a partnership, company, or other legal entity without breaching the terms of the agreement or engaging in improper conduct.

Past Debts

Obligations or amounts of money owed that were incurred in the past.

Q24: Ivory Corporation,a calendar year,accrual method C corporation,has

Q44: A father wants to give a parcel

Q44: The Yellow Trust incurred $10,000 of portfolio

Q51: Netting refers to the process of AMT

Q77: Harry and Brenda are husband and wife.Using

Q89: Which of the following statements is incorrect

Q104: The use of the election to split

Q115: Frank owns an insurance policy on the

Q115: Hopper Corporation's property holdings in State E

Q117: The Doyle Trust reports distributable net income