Essay

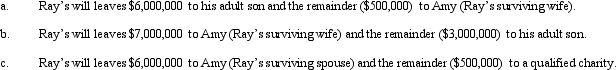

In each of the following independent situations,describe the effect of the disclaimer procedure on Ray's taxable estate.In this regard,advise as to how much should be disclaimed,by whom,and whether a disclaimer should be made,for the death in 2011.

Understand the principles of negligence and product liability.

Identify the factors courts consider in determining manufacturer negligence.

Explain the concept of strict product liability and the parties that can be held liable.

Recognize the role of federal preemption in state tort law concerning product safety.

Definitions:

Related Questions

Q1: Cost and time are usually saved by

Q6: Discuss the adjusted current earnings (ACE)concept.

Q8: Wesley has created an irrevocable trust: life

Q18: Bettie,a calendar year individual taxpayer,files her 2011

Q48: Adrian is the president and sole shareholder

Q68: The election of § 2032 (alternate valuation

Q70: For the IRS to grant a discretionary

Q93: Tom and Jean are husband and wife

Q110: The Code defines a grantor trust as

Q144: The purpose of the excise tax imposed