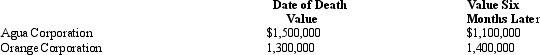

At the time of his death,Trent owned some common stock.  The Aqua Corporation stock is sold by the executor of the estate five months after Trent's death for $1,300,000.If the alternate valuation date is properly elected,the value of Trent's estate as to these stocks is:

The Aqua Corporation stock is sold by the executor of the estate five months after Trent's death for $1,300,000.If the alternate valuation date is properly elected,the value of Trent's estate as to these stocks is:

Definitions:

Q4: Double taxation of corporate income results because

Q12: Circular 230 requires that the tax practitioner

Q44: A father wants to give a parcel

Q45: A disclaimer by a surviving spouse will

Q47: Crow Corporation,a C corporation,donated scientific property (basis

Q54: Usually a business chooses a location where

Q60: Peach Corporation had $210,000 of active income,$45,000

Q80: A lifetime transfer that is supported by

Q85: Lemon,Inc. ,a private foundation,engages in a transaction

Q167: In 2010,Katherine made some taxable gifts upon