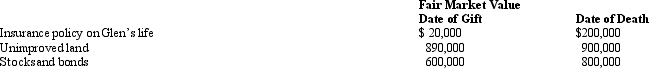

In 2010,Glen transferred several assets by gift to different persons.Glen dies in 2012.Information regarding the properties given is summarized below.  The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000.As to these transactions,Glen's gross estate must include:

Definitions:

Frequency

The number of occurrences of a repeating event per unit of time.

Sleep Spindles

Short bursts of brain activity that occur during stage 2 of non-REM sleep, thought to play a role in learning and memory.

K-complexes

Brainwaves seen in stage 2 sleep that are characterized by a brief and well-defined downward deflection followed by an upward component.

N1 Sleep

The initial stage of the sleep cycle, representing the transition from wakefulness to sleep, characterized by light sleep and reduced sensory awareness.

Q2: Joint tenancies and tenancies by the entirety

Q11: A Federal gift tax return does not

Q50: Commercial annuity contracts should be valued using

Q51: Derrick dies,and under the terms of his

Q82: A timely issued disclaimer by an heir

Q123: At the time of his death,Lance held

Q127: Henrietta has hired Gracie,a CPA,to complete this

Q128: If a state follows Federal income tax

Q141: In most states,a limited liability company (LLC)is

Q142: In 2000,Dale and Andrea acquire real estate